Budget airline Ryanair reported a 20 million euro ($22.88 million) loss for its third quarter on Monday, citing weaker fares due to excess winter capacity in Europe.

“While a 20 million euro loss in Q3 (third quarter) was disappointing, we take comfort that this was entirely due to weaker than expected air fares so our customers are enjoying record low prices, which is good for current and future traffic growth,” CEO Michael O’Leary said in a statement.

The company saw a loss of 19.6 million euros for the quarter, against a profit of 105.6 million euros for the same period the year before. Revenue came in at 1.53 billion euros versus 1.41 billion euros the year before, a rise of 9 percent.

The company also warned that fare prices could see continued weakness. Ryanair said it could not rule out further cuts to air fares and/or slightly lower full-year guidance especially if there are unexpected Brexit and/or security developments.

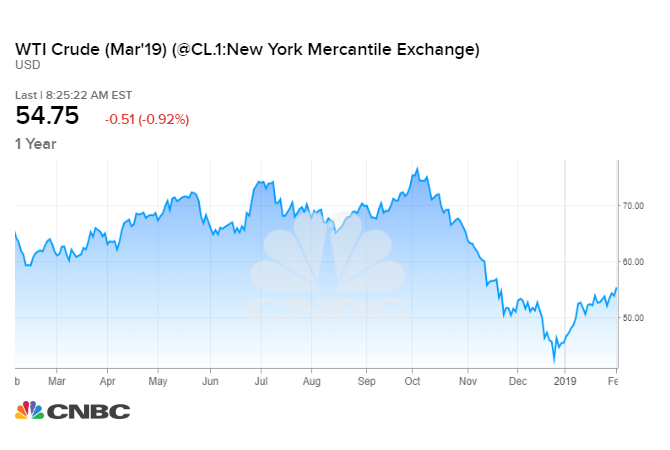

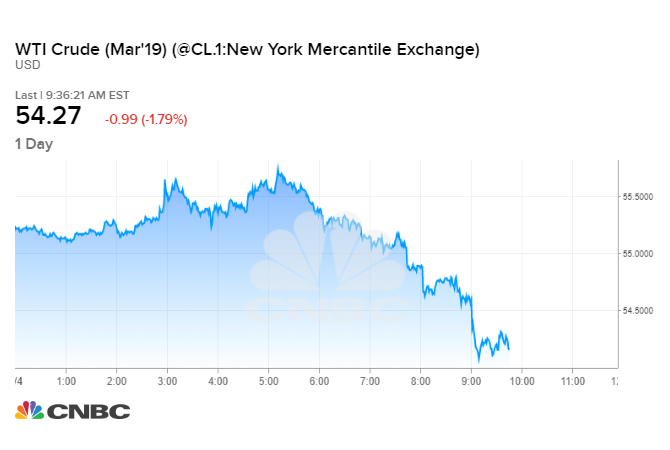

“We do not share the recent optimistic outlook of some competitors that Summer 2019 airfares will rise. In the absence of further EU airline failures, and because of the recent fall in oil prices, we expect excess short haul capacity to continue through 2019, which will we believe lead to a weaker — not stronger — fare environment,” the company said in a statement.