The race for the 2020 Democratic presidential nomination is quickly becoming a contest to determine which candidate wants to tax the rich the most.

Sen. Elizabeth Warren has proposed an “ultra-millionaire” tax on the wealthiest families in America. Sen. Bernie Sanders wants to jack up the estate tax for rich heirs. Sen. Kamala Harris wants to roll back the 2017 Republican tax cuts to funnel more money to low- and middle-income earners.

These proposals and others like them are shaping the early days of the campaign for the White House, as the party prepares to use President Donald Trump’s tax law against him. The GOP tax overhaul has only about a 40 percent approval rating, as Democrats argue it favored corporations and fueled record stock buybacks rather than helping workers.

Taxing the rich to reduce income and wealth inequality has an obvious political appeal. Polls show a majority of Americans believe the government goes too easy on the rich. Many Democrats see the argument as particularly effective with a billionaire developer in the White House and two more super wealthy business titans — Howard Schultz, a former Democrat, and Michael Bloomberg, a newly registered Democrat — potentially joining the race.

“An extreme concentration of wealth means an extreme concentration of economic and political power,” University of California, Berkeley, economics professors Emmanuel Saez and Gabriel Zucman wrote in a New York Times column responding to New York Democratic Rep. Alexandria Ocasio-Cortez’s proposal to dramatically increase the top tax rate. Saez and Zucman, left-leaning economists and two of the leading scholars on inequality, advised Warren on her tax proposal.

But does soaking the rich work? History from last century could be a guide — and the U.S. has a precedent for significantly higher tax rates on the wealthy.

The big new idea on taxing the rich is actually a bit of a throwback.

The current debate kicked into overdrive in January, when Ocasio-Cortez, a 29-year-old freshman representative who is not eligible to run for president because she’s six years too young, floated a 70 percent marginal tax rate for $10 million in income and above. Her proposal terrified the billionaire elite last month at the annual World Economic Forum in Davos, Switzerland. The last time the U.S. saw a headline number that high was 1981, Republican Ronald Reagan’s first year in office. Those rates were eventually slashed during Reagan’s tenure.

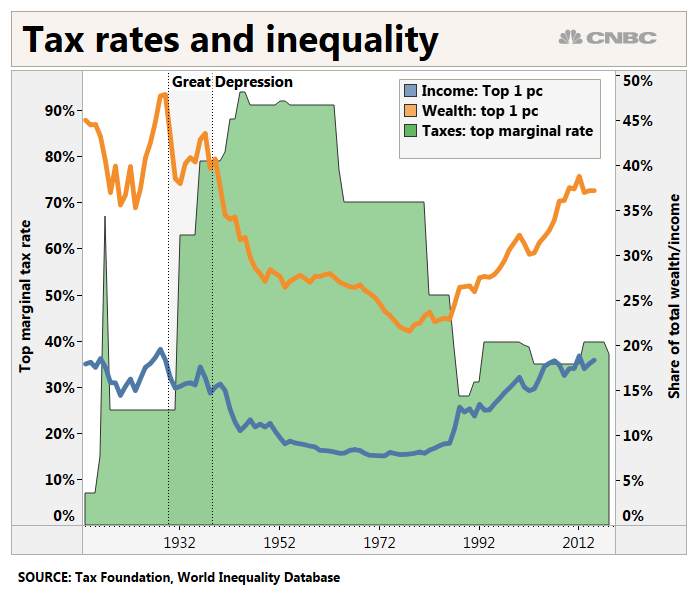

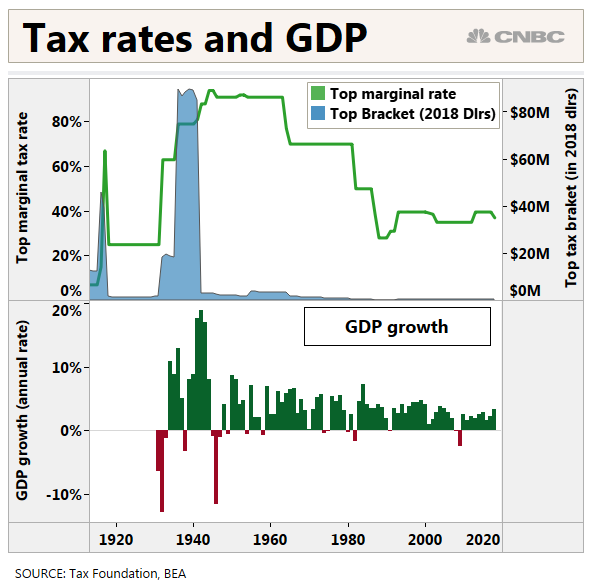

For decades, however, the top marginal tax rate hovered between 63 percent and 92 percent. While the gap between the poor and wealthy was smaller then, it is unclear how much tax policy on its own influenced gross domestic product growth during that span.

The marginal rate for the top U.S. tax bracket spiked to 67 percent in 1917 as America pushed to fund World War I, according to the Tax Policy Center. After temporarily falling, the highest tax rate rose again to 63 percent in 1932, during the Great Depression.

The rate on the wealthiest Americans never dipped below 69 percent from then until 1982, when it dropped to 50 percent. It held above 90 percent from 1951 through 1963. Now, the top marginal rate sits at 37 percent.

The true disparity between the tax burden today and the mid-20th century may not be quite so large. The Tax Foundation, citing research from Saez, Zucman and French economist Thomas Piketty, notes that the top 1 percent paid about 6 percentage points more in federal, state and local income taxes in the 1950s than it does today.

The U.S. had a more equitable distribution of wealth and income during those periods of higher taxes on the wealthiest Americans. The top 0.1 percent of Americans held roughly 10 percent of wealth in 1960, versus about 20 percent today. The wealth of the bottom 90 percent of Americans dipped from just under 30 percent to about 25 percent now.

Those wary of higher taxes on the wealthy warn the policy changes would stifle economic growth and deter innovation from talented entrepreneurs. A 2014 Tax Foundation analysis suggested a wealth tax as previously proposed by Piketty would shave about $800 billion off gross domestic product annually and depress wages.

Gary Cohn, the former Goldman Sachs chief operating officer and economic advisor to Trump, argued last week that hiking taxes on the wealthy “would be harmful to the economy.”

Proponents of the recent round of tax cuts — spurred through Congress in part by Cohn — have argued that the measure has helped boost economic output by spurring hiring and investment. Tax cuts have also traditionally been seen as a reliable way to stimulate household spending by putting more money in consumers’ pockets.

The U.S. economy has weathered much higher tax rates in the past 100 years with little apparent effect on the ebb and flow of economic growth, though. The highest marginal rate topped 90 percent during World War II, falling to 70 percent from 1965 to 1981, a period including economic expansion and recession. Those deep Reagan era tax cuts helped spur growth during that decade, but didn’t prevent subsequent recessions that began in 1990, 2001 and 2007.

A high marginal tax rate “doesn’t seem to hurt economic growth and maybe even spurs it” by putting more money in consumers’ pockets, according to Matthew Dimick, a professor at the University at Buffalo School of Law who studies the relationship between law and inequality.

Proponents of lower taxes, though, point to America’s massive, innovative corporations as a success story. In a post on Jan. 25, the American Enterprise Institute’s Jim Pethokoukis, a CNBC contributor, also questioned how a higher tax burden on the rich would affect business formation and risk taking.

“America must be doing something right since it has Apple, Google, and Amazon, and Europe doesn’t,” he wrote.

Yet, high marginal tax rates in the 1960s didn’t inhibit development of such watershed technologies as the microchip or satellite communications.

Western Europe, which broadly has higher income tax rates than the U.S., has seen income inequality grow much more slowly than the U.S. The share of national income received by the top 1 percent in the region grew only to 12 percent in 2016, versus 10 percent in 1980.

France, Germany and the United Kingdom all had top individual income tax rates of at least 45 percent in 2017, compared with under 40 percent in the U.S., according to the OECD. Austria, Belgium and Israel all topped 50 percent. Those rates do not include all taxes separate from those on income, which are generally higher in Europe, where governments broadly cover more social services.

Of course, detractors of raising taxes on the wealthy would also point to the fact that those countries’ economies are largely growing at slower rates than the United States. And, even outside the U.S., governments have not had an easy path when attempting major tax hikes. France faced resistance when former President Francois Hollande tried to raise the tax rate on millionaires to 75 percent. The country abandoned the idea in 2014.

Tax policy changes, particularly hiking rates on the wealthy, are the most common tools proposed to reduce the income and wealth gulfs while funding social programs. Opponents of tax increases say they will not only hamper economic growth, but also discourage entrepreneurs from innovating.

For instance, Warren’s team says her “wealth tax,” which would apply to people with more than $50 million in assets, is projected to raise $2.75 trillion over a decade. That revenue, under the proposal, would then be put toward programs such as child care, student loan forgiveness and green energy.

The calls for a higher marginal tax rate, bigger estate tax or wealth tax follow years of wealth concentration by the upper reaches of American society. The plans offered by Warren, Ocasio-Cortez and Sanders would work differently and potentially cause different outcomes, but they fit into a broader debate about how much the richest Americans should owe.

Concerns about the assets amassed by the so-called 1 percent helped to drive the ascents of Warren and later Ocasio-Cortez. Sanders rode rhetoric about inequality to a strong showing in the 2016 Democratic presidential primary, while even Trump pledged to raise his own taxes as a candidate. (It’s not clear whether this happened, as the president has broken with tradition and refused to release his tax returns.)

The top 1 percent of earners in the United States took in about 20 percent of the income in the United States in 2016, up from 11 percent in 1980, according to the 2018 World Inequality Report written by Saez, Zucman, Piketty and others. At the same time, the income share of the bottom 50 percent of Americans dropped to about 13 percent in 2016 from just above 20 percent in 1980.

In a recent letter to Warren outlining the case for a wealth tax, Saez and Zucman wrote that “one of the key motivations for introducing a progressive wealth tax is to curb the growing concentration of wealth.” They noted that the top 0.1 percent’s share of wealth climbed to about 20 percent in recent years from 7 percent in the late 1970s. The wealth held by the bottom 90 percent of Americans has dipped from about 35 percent to 25 percent in that span.

Public opinion shows why Democrats have focused on the issue. A solid majority of registered voters, 59 percent, back the 70 percent top rate floated by Ocasio-Cortez, according to a Hill-HarrisX poll. Forty-five percent of Republican respondents to the survey support the plan, versus 55 percent who oppose it.

Americans also generally worry about the U.S. giving its richest citizens too much leeway. About two-thirds of Americans think the government does too much to help wealthy people, according to a January 2018 Pew Research survey. A 77 percent majority of Democrats believes the U.S. gives too much of a boost to the rich, and a 46 percent plurality of Republicans agrees.

Proposing to reduce inequality goes beyond its appeal as a campaign issue. Proponents of policy to close the wealth and income gaps worry about political, economic and social fissures in the future if the issue goes unaddressed.

In a 2017 speech, Federal Reserve Governor Lael Brainard said inequality could damage the economy through lower consumer spending, “as the wealthiest households are likely to save a much larger proportion of any additional income they earn relative to households in lower income groups that are likely to spend a higher proportion on goods and services.” She pointed in part to a 2016 International Monetary Fund working paper that suggested aggregate consumption dropped by about 3.5 percent from 1998 to 2013 due to inequality.

Critics of the income and wealth gap also worry about further educational disparities. Inequality’s potential effects on education and opportunity show in an October Pew survey. Overall, 17 percent of U.S. teens said they often or sometimes could not finish homework assignments due to an unreliable computer or internet connection. Among teens whose families have an annual income of $30,000 or less, the proportion rises to 24 percent. But only 9 percent of teens whose families make more than $75,000 say they have the same problem.

Beyond those potential pitfalls, professors who study inequality have warned about an accumulation of wealth potentially eroding democratic institutions. Policymakers have crafted laws more often to fit the preferences of the rich, and inequality only exacerbates the problem, according to the University of Buffalo’s Dimick.

“Once you have concentrated economic power, that leads to concentrated political power, and that’s pretty dangerous for democracy,” he said.

Graphics by CNBC’s John Schoen

Subscribe to CNBC on YouTube.