During just six months, crude oil prices ripped higher by about 20 percent, plunged more than 40 percent and snapped back 25 percent, an intense volatility that analysts warn could be the new normal in the oil market.

December was a real nightmare for the global market where the swings were $50 at a low, $86 at a high and $68 for the average of Brent crude oil. Brent was trading at about $62.44 per barrel in the futures market Tuesday, while Western Texas Intermediate was $54.25 per barrel.

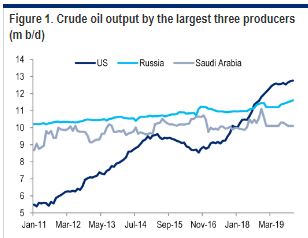

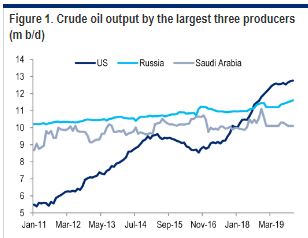

Booming U.S. oil production and the rise of the United States to become the world’s largest producer has certainly factored in the shift away from OPEC as the main entity controlling supply and prices. In 2016, Saudi Arabia led other OPEC members to align with Russia and other producers to use their combined clout to manage global energy prices.

Another factor new to the market is the active participation of President Donald Trump, who through tweets and comments has pressured both Saudi Arabia and OPEC to let up on production when prices are high. Trump has also moved to sanction two members of OPEC, Iran and Venezuela, impacting global oil supply.

“In this boom-bust era, as in prior ones, you can have a year or two of stability, but in general when you don’t have an effective swing producer and you have big imbalances and geopolitical risk,” there’s volatility, said Robert McNally, President of Rapidan Energy Group. “I’m telling everybody, ‘Buckle up.’ That’s the market we’re in for the foreseeable future.”

The Saudi-Russia alliance raised production last summer to help add oil to the market ahead of the Iran sanctions and amid concerns of a tight market. Russia and Saudi Arabia touted their joint effort and their broader relationship was front and center last year when a smiling Russian President Vladimir Putin met Saudi Crown Prince Mohammed bin Salman on the sidelines of the World Cup.

The new dominance of the U.S. in the oil market, combined with the Saudi-Russia alliance, means new tensions, and the industry will have to adjust.

“It certainly means we’re going to be in a more volatile world when it comes to oil prices. I think it means more caution about long cycle oil projects. I think that’s an immediate impact,” said Daniel Yergin, vice chairman of IHS Markit. “I think the oil price is moved by what happens with the overall financial markets. It means sentiment will have a bigger impact on the oil price. A big surge in U.S. oil production becomes bearish for the global market so you get more and more complicated feedback loops.”

The 20 percent surge in prices during last summer came as the market anticipated the sanctions by the U.S. would take most of Iran’s oil off the market. At the time, the Trump administration had warned there would be no waivers, and that all of Iran’s oil would be forced off the market. But by fall, when sanctions were close to going into effect, the Trump administration granted some exemptions to countries that buy Iranian crude and oil prices tanked.

The drop accelerated as investors became fearful about a global economic slowdown. But since Dec. 24, prices for West Texas Intermediate crude have come back by about 28 percent. Prices have been rising most recently on the idea that the U.S. will keep Venezuelan oil off the market.

As the U.S. moves to sanction Venezuela because of unrest and the humanitarian crisis under the leadership of the Maduro government, some analysts say the Saudi Arabian-Russian alliance may not be so quick to make a move to end the production cuts they put in place in December after oil prices began to plunge.

“There’s nothing to indicate today that the Saudis have any intent of rushing to fill the gap,” left by Venezuela, said Helima Croft, chief global commodities strategist at RBC. “They were early with their surge, and they oversupplied the market in the run up to the [Iran] sanctions decision.”

Analysts believe Venezuela is producing less than 1 million barrels a day, and its exports appear frozen, as the government demands cash for cargoes. Croft said she was expecting 300,000 to 500,000 barrels to be removed from the market without the sanctions, but now there could be several hundred thousand more.

“I think the market over-fixated on the [Iran] exemptions, but the Saudis opened the spigots in a big way. They opened the floodgates,” said Croft. Saudi Arabia ramped up production to just over 11 million barrels a day in November, just as the Trump administration was about to announce it was exempting India, Japan, and South Korea, among others, from full compliance with the Iranian sanctions.

McNally said the market believed that the exemptions would not be granted, as they had been during the Obama administration when the United Nations sanctioned Iran’s oil sector. That started oil’s freefall which continued into late December.

“The only thing President Trump hates more than Iran is high oil prices. He went easy and the price collapsed,” McNally said.

Croft said she had been concerned that Trump’s comments on high oil prices, made around the midterm elections, could backfire.

“The way he talked down the price of oil, he was really imperiling the financials of the countries that had been very helpful to him during the summer,” Croft said. “Was that social media fist pumping going to come back to haunt him? Can he cajole them to do this? I don’t know if he can get them to act against their own economic self-interest. I think the Saudis are pursuing a ‘Saudi first’ policy. You cannot say that the Saudis and Emiratis were not helpful to the Trump administration. He seemingly has a price target that’s substantially lower than theirs.”

John Kilduff of Again Capital said the Saudi-Russian alliance reacted too quickly to replace Iranian crude and it could again. “It’s making matters worse. It’s like an amateur trader. They’re getting sucked in at the market bottom and at the top.”

Saudi Arabia and Russia may also not be as close in their view on supply as their partnership would suggest. Russian oil companies have opposed the cuts, and Saudi Arabia is shouldering the bulk of them. Eric Lee, energy analyst at Citigroup, said Saudi Arabia envisions itself as a central banker of oil that helps stabilize the oil price.

“But there are a couple of flaws in that. One is that they’re not a dispassionate central banker that’s independent. They have their own interests. Their interests are that for their government spending, they need oil revenues. They would love oil prices in the $70s and $80s. That’s what it would take to balance their budgets,” he said.

“The Russians are separating from them as well. They need the Russians more than the Russians need them in many ways, there’s a balance but at least economically, the Saudis need $70 to $80. Russia budgets for $40 and the government is more insulated by the ruble,” Lee said.

Analysts said the partnership could ultimately back off the production cuts, and there’s a meeting coming up in April where production will be discussed.

“You have a couple too many cooks in the kitchen. Even as other people are running around doing their own thing, there’s a couple of dynamics,” Lee said. “How many more rounds do the Saudis try to cut or hold cuts to support prices in the near term. At what point might they see market share is being lost and at what point do they flip again?” Lee said.

Source: Citigroup

Lee said he expects the arrangement between Russia and Saudi Arabia to hold together.

“There’s a benefit of Putin being extremely engaged as being an oil market kingpin, geopolitically and in the Middle East,” he said. “I’m not talking about a schism. It’s just when it comes to talking about whether to cut, the Russian position is much more reluctant to cut or hold cuts longer. Their industry certainly doesn’t want it, and the Russian government itself doesn’t need it anywhere as much as the Saudis do.”

But the U.S. production is also factor impacting prices. At 11.9 million barrels a day, the U.S. is producing 2 million more barrels a day than it was last year, according to weekly data from the Energy Information Administration.

“Out to 2023, prices might only need to be $45 to $60 because when you go above that or below that you have too much shale, or too little shale. It means whenever Saudis want to push prices out of that range, there’s going to be an opposite reaction to that that gives them trouble,” Lee said.

Kilduff said oil rose about 10 percent on the Venezuela sanctions, but it has also been swinging up and down on the rig count in the U.S.

“I think they’re having a difficult time, the Saudis in particular, and OPEC with this new paradigm. They tend to overshoot both ways and they kind of got suckered into putting more oil on the market because of the Iranian sanctions fears and they’re trying to rein it back in after the price collapse,” Kilduff said.